“We believe that APRA’s statement to improve brand new serviceability floor is actually a smart and you can appropriate action to greatly help require some of your temperature from the housing market,” the fresh Commonwealth Bank’s leader Matt Comyn said for the an announcement.

“Having enhanced all of our flooring to help you 5.twenty five per cent within the June we think this after that step often give most comfort for consumers and is a wise measure to own lenders.”

Adrian Kelly, the fresh chairman of your own A property Institute out of Australian continent (REIA), said most consumers do not take out loans on their restrict capability therefore the changes should have a moderate perception.

“REIA provides constantly need in control financing means as very last thing we want to find in the industry is anybody biting out of more they are able to chew,” he told you.

“We may all the like to see a get back to a more balanced markets with some longevity so you can they, and another way to go back to that’s by the addressing have that should activate once the lockdowns stop and a lot more characteristics become on market.”

Subsequent constraints ‘may feel necessary’

Many experts got requested a relocate to tighten mortgage conditions immediately following present statements regarding authorities as well as the Treasurer, but most did not predict the alteration to happen so fast.

Reserve Financial governor Philip Lowe says he knows issues about fast home rates development, however it is providing home money to expand.

In the context of the current energy of your own housing market this is a modest more changes, said ANZ’s lead from Australian economics, David Plank.

APRA agrees you to definitely the overall impact on aggregate houses borrowing from the bank gains flowing out of this is expected getting fairly more compact.

RBC’s Su-Lin Ong told you APRA got its newest strategy as it was a tried and true method which had been more straightforward to pertain than most other choices, such as for example a threshold towards the higher debt-to-income loans.

“The studying from the present APRA statement, coupled with our very own assessment from borrowing from the bank development, instance in order to key cohorts particularly people, implies that after that tips are likely if the elevator in the boundary rates don’t state of mind borrowing from the bank increases,” she warned.

“That have an information paper layer almost every other macropru choices set to become put-out in some months’ go out, i assume you to definitely APRA is currently hard in the office for the logistics off implementing after that strategies.”

“We will apply the changes that it day and you may predict this can be necessary to think extra measures because lockdowns avoid and you will user believe increases,” Mr Comyn extra.

Code transform browsing affect dealers really

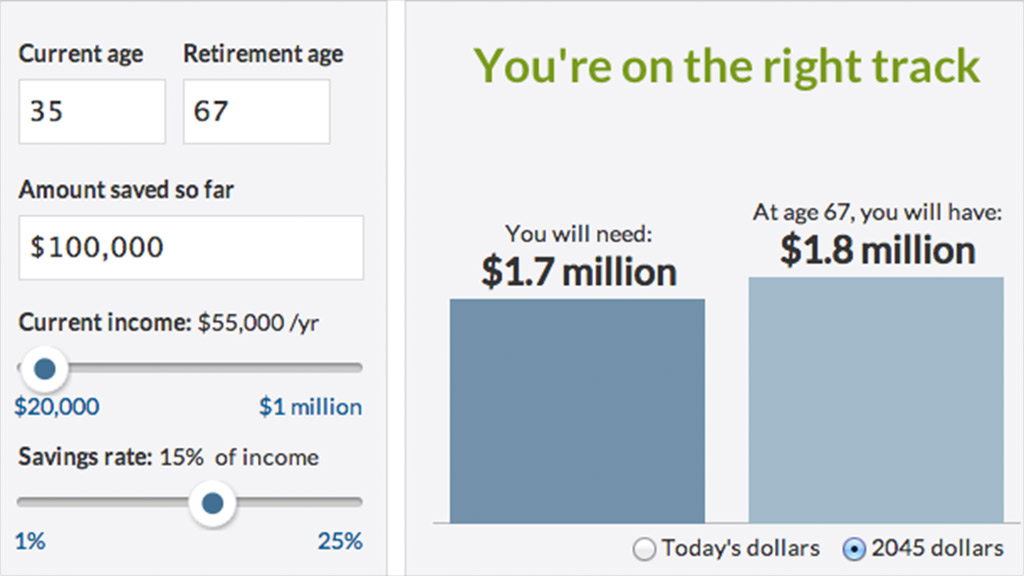

APRA told you the brand new rule transform is actually expected because there was actually a serious upsurge in people borrowing huge wide variety inside previous months.

Regarding ple, more 20 per cent from ADIs’ the latest credit would be to individuals that had borrowed more six times their pre-income tax income.

Buyers go back to the home market

Buyers create a come-straight back while the family cost go through the rooftop. Financial institutions was fuelling the fresh madness by the cutting buyer prices.

The increase throughout the interest rate boundary pertains to new borrowers, but APRA told you the fresh new effect off a high serviceability barrier try more likely larger getting traders than just holder-occupiers.

They told you the reason being, on average, people have a tendency to use during the higher amounts of influence and may has actually other current bills (that the buffer would also be reproduced).

They noted you to first home buyers is under-portrayed as the a percentage regarding consumers credit a top several out of their money as they are more restricted of the size of its put.

“More than one into the four the fund accepted on the Summer quarter had been from the over half dozen times brand new borrowers’ money, and at a keen aggregate height new presumption is that property borrowing growth will run prior to household income growth in the period ahead.”