Before you can rating as well thrilled, be aware of the risks.

- Email address icon

- Twitter icon

- Facebook symbol

- Linkedin icon

- Flipboard symbol

Have you received an effective preapproved offer on the send that it vacation seasons that looks eg a check, produced out over you and willing to cash? Before you can hurry to your lender, visions regarding presents dance in mind, know that it is far from totally free dollars. Rather, it’s likely to be a costly financing.

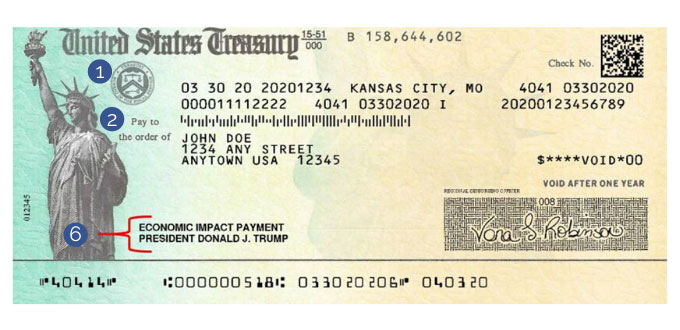

Such as for example prescreened post also offers, or alive inspections, are personal loans delivered off banking institutions or loan providers to help you users which satisfy specific requirements, such as for example the absolute minimum credit history. Cashing this new view goes into you on financing arrangement that can past numerous many years and have now a yearly interest significantly more than twenty five%.

Chris Jackson acquired a real time register the fresh mail last November for $2,five hundred which have an excellent twenty-eight% interest rate. Jackson, a monetary coordinator, is suspicious, but their family relations responded differently.

I inquired my family what they should do which have [the fresh new glance at], and undoubtedly they told you they will cash it, claims Jackson, creator out-of Lionshare Couples, a financial believe organization within the La.

It explained which was sweet to have additional bucks for the getaways. But it is perhaps not cash, while the price try worse than a charge card, says Jackson.

Real time checks: The costs and you will risks

Most lenders that provide alive inspections dont think about your employment position, money or capacity to pay-off a new obligations. Commonly, the fresh finance was expensive getting individuals that have most other costs so you’re able to shell out, claims Carolyn Carter, deputy director within National Consumer Legislation Cardio, a great nonprofit user suggest providers.

Pressing borrowing from the bank toward people once they have not actually wanted it can merely make them becoming overextended, Carter states.

U.S. senators Doug Jones (D-Ala.), Tom Cotton (R-Ark.), and you may Jeff Merkley (D-Ore.) produced laws to quit whatever they telephone call new predatory habit of emailing alive monitors in order to consumers. Brand new Unwanted Financing Operate of 2018, lead Dec. 10, do make sure that users get loans on condition that they make an application for him or her. This new senators intend to push the bill forward inside 2019.

Mariner Finance directs alive monitors with pricing as much as thirty-six %. For the 2017, Local Financing shipped more 6 billion real time checks and you can acquired the average produce of 42% into the short fund ($five-hundred to help you $dos,500), and real time inspections, centered on their yearly statement.

- Credit insurance policies, often referred to as payment safeguards insurance, is a choice which covers the borrowed funds harmony if you fail to pay-off on account of dying, involuntary unemployment or disability. Its an unnecessary prices in case the borrower already has actually lives otherwise impairment insurance, Jackson claims.

- Refinancing are considering if you’re unable to pay-off the borrowed funds. You earn more income and a longer fees name, as well as even more interest and you can possibly a keen origination payment.

- Attorney costs may be recharged for people who default towards financing. Like charges, the expense of and that varies of the county, safety the fresh lender’s costs regarding desire lawsuit up against your.

How to proceed if you get an alive glance at

Research the bank. Find out if the lender is actually subscribed to-do business on the condition using your country’s financial regulator. Go to the Consumer Monetary Safety Bureau grievance database to see if the lender provides problems.

Browse the financing contract. Understanding the loan’s pricing and you will terms assists dictate its cost. New agreement will be detail the total annual price of borrowing, depicted once the an apr and you can also focus can cost you and you will fees; how many required payments; and you may percentage wide variety.

Shop aroundpare unsecured loan cost and you may words in the credit unions, banking institutions and online loan providers. When you have less than perfect credit, you will be able to find down pricing during the government borrowing from the bank unions, and that cap rates toward funds on 18%. You https://availableloan.net/loans/loans-for-immigrants/ could see costs and you can words in the on the internet lenders. Most work at a silky pull-on the borrowing, which has no influence on your credit rating.

Manage long-term choices. Carry out a resources you to definitely songs the spending, that pick so many spending which help you only pay regarding obligations otherwise lead currency so you’re able to a crisis finance. Then you can use dollars for emergencies in lieu of highest-focus credit.

Tear it. Shred and you can put new check in the trash if you don’t require the deal. You are able people you’ll bargain their glance at, sign and money it on your own title. Multiple individual issues during the CFPB high light the brand new name-theft likelihood of live checks.