Are you ready to enhance forget the collection and you will add a great a home advantage? Investing an extra domestic for personal play with or a good investment assets for rent income are both expert resource tips. Exploring the similarities and differences between all are essential in making suitable choice for your money needs.

What’s the second domestic?

The next house is a house an investor sales private fool around with. You can live-in your next family getting a portion of the seasons otherwise utilize it as a vacation house.

Is felt a second domestic by the Internal revenue service (IRS) and you may loan providers, the property need to fulfill specific standards, together with becoming an individual-members of the family property. This loan places Concord means it must be a beneficial freestanding, single-product possessions with enough household for only you to family per check out.

Extremely loan providers as well as ban one minute domestic off getting further than fifty kilometers from your own first residence or beneath the supervision of a property management team. Timeshares are excluded of are noticed an additional domestic. Basically, another house is perhaps not much of your residence otherwise a secured item you use to earn leasing earnings.

What’s an investment property?

A residential property is actually an asset you buy to produce rental money. You could turn the latest money for the an initial-identity otherwise long-label rental property to generate income, both thanks to month-to-month mortgage payments or mainly based equity.

Getting classified because an investment property, lenders usually exclude buyers regarding occupying your house. Financing features can have one or more device that can feel further than fifty kilometers on the investor’s number 1 household.

Actually, certain leasing functions may be located in a hotel otherwise vacation area to focus on small-identity renters. Additionally it is enjoy (and you can popular) getting a landlord to control their investment property.

An investment property ily quarters having up to five gadgets, a professional property, or good condominium. Funding properties cannot be first houses.

There are many key differences when considering the second home and a residential property. Such variations have high money, tax, and you can funding ramifications.

The next residence is readily available for individual fool around with, while an investment property is for earnings. Funding properties create taxable income, while an additional domestic will not. not, and also this function you might subtract notice and you may costs towards investment property considering latest tax statutes.

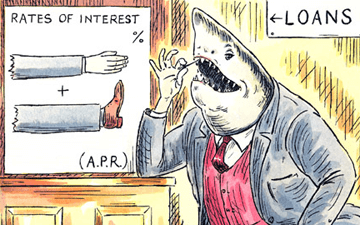

There are also certain differences in financing qualification toward one or two property products. Mortgage brokers generally speaking want high credit scores and you can deposit to own investment property resource.

An extra home’s deposit is frequently ranging from 5 in order to 10% of cost, and you will resource characteristics routinely have more strict credit standards having ranging from fifteen so you’re able to twenty five% down repayments on most home loan systems.

The utmost obligations-to-income (DTI) and you may minimum bucks reserve requirements was equivalent for both financial support attributes and you may next residential property. Most loan providers simply make it a max DTI off forty five% and often need around 6 months of money reserves to possess one another assets products. Solution loans, instance financial obligation-services publicity proportion (DSCR) , are available with most readily useful minimum deposit and you can credit history criteria.

Similarities Between Second Homes and you may Capital Attributes

There are several parallels understand between the next family and an investment property, also. Neither another family neither an investment property is a first home, definition investors can’t live on the house complete-go out.

Money spent financing can also be found both for asset versions. not, the borrowed funds terms and conditions can vary ranging from every single brand new relevant lender. Second land, same as money properties, are not qualified to receive FHA financing.

Sometimes, choosing whether or not a secured asset is an additional family or money spent was advanced. Particular traders get purchase property as the an additional house with the objective of leasing it sometimes.