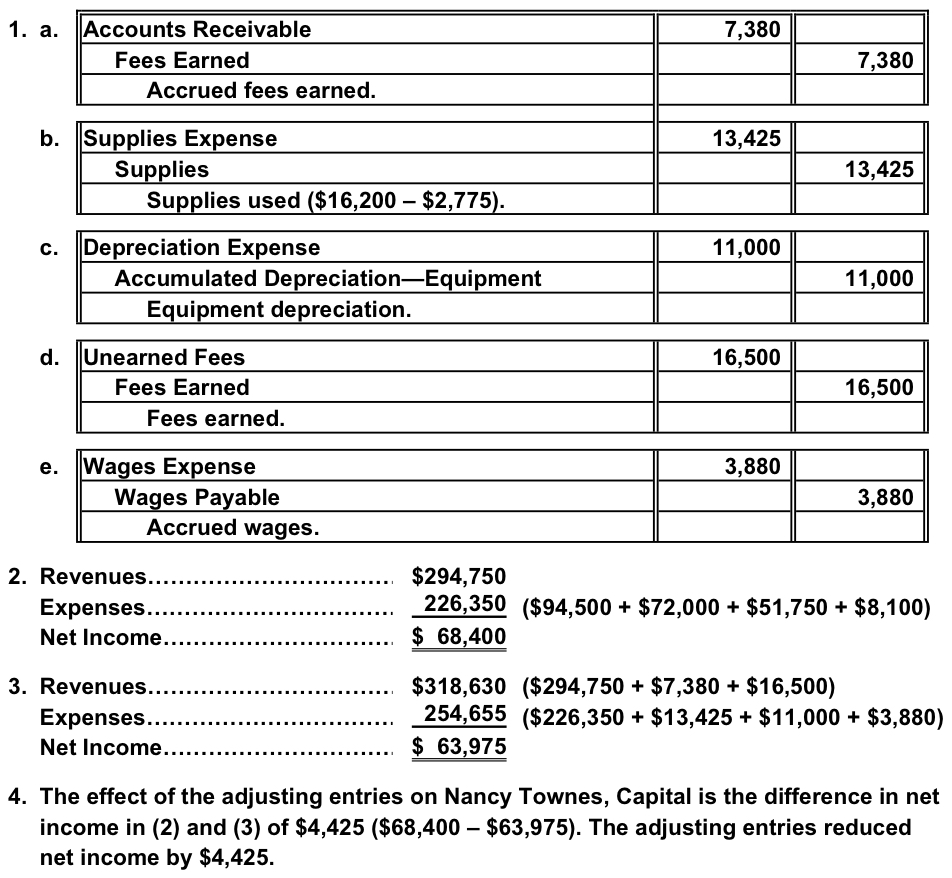

If the FHA longer their Underwriting Guidelines in 1938, they added a several-level ranking with the society place, toward a size out-of An inside D, situated mostly towards the HOLC Town Coverage Map product reviews. Updated FHA assessment forms together with provided certain requirements to specify the predominant racial composition of your own neighborhood: Light, Blended, International, and you may Negro, because the shown when you look at the Profile dos.11. 33

Contour 2.11: The fresh new FHA introduced requirements to point the fresh new prevalent racial constitution of communities within the 1938 Underwriting Guide. Organized because of the HathiTrust.

As stated above, FHA created a unique color-coded Community Ratings Charts within the 1935, and you can used these to redline varied area neighborhoods and refute authorities-supported mortgage loans. Handful of these FHA redlining maps live about archives, which have nothing getting Hartford, however, we know you to definitely their four-colour risk accounts (A-eco-friendly, B-bluish, C-purple, D-red) shown the existing HOLC maps as well as the FHA Underwriting Guide requirements more than. 34

several. Become clear, the latest shade in this FHA Cut off Research Chart reveal an average month-to-month lease (blue is the higher, accompanied by yellow, tangerine, and you may purple) and don’t depict redlined elements. However, into the per area cut off is seven amounts, therefore the history shows Per cent of Final amount of Houses away from a race except that Light. Historian Lawrence T. Brownish explains how Stop Analysis Charts were ultimately FHA Negro-recording charts, designed to reveal where exactly racial infiltrations have been ascending and you may FHA home loan applications would likely become refused, according to racist criteria on Underwriting Guidelines. In reality, brand new FHA advertised their the latest wall-size of Stop Research Charts since the magic carpets’ to have mortgage lenders so you’re able to very nearly travel as much as a community and watch new possible balances from a neighborhood additionally the fashion which may end up being going on indeed there…. (such as for example) whether you’ll find inharmonious racial teams on the area, and revitalize memory to what chances areas inside the a neighbor hood. After it FHA book, Connecticut subscribers was basically brought on FHA place of work when you look at the Hartford, where the chart is present to possess viewing. thirty-five

FHA written which chart to the Works Improvements Management to assume economic and demographic details across Hartford communities

Figure dos.12: View the complete-size FHA 1939 Take off Study Chart to possess Hartford, digitized by Federal Archives. The fresh new inset shows that per area block comes with seven quantity, in addition to history shows new Per cent from Final amount out-of Domiciles out-of a rush besides Light, so you can alert customers about FHA’s rules up against lending so you’re able to communities which have racial infiltrations.

Color portray average leasing costs, Maybe not redlined areas

Opponents talked away up against the FHA’s racist credit policies. Within the June 1938, Roy Wilkins in the National Relationship towards Improvement Colored Anyone (NAACP) composed so you’re able to Robert Weaver, a black special secretary in the us Construction Power, so you can relay you to definitely a white FHA worker got tipped them off in the battle restrictive covenants regarding the home loan direction. New NAACP mag The brand new Drama stated in 1939 one a region department in the Queens, Ny examined problems off Black homeowners whoever FHA apps was basically refuted. When pressed from the NAACP lawyer Thurgood Marshall, local FHA authorities accepted that zero mortgage loans have been guaranteed getting coloured members of people community hence is actually lower than fifty% Negro. NAACP movie director Walter Light published so you’re able to Chairman Roosevelt so you’re able to demand the newest removal of the brand new segregationist condition on incompatible racial and you can societal communities throughout the Underwriting Tips guide, but FDR postponed and you may deflected in the impulse. Black colored press examined these issues, turning even more notice regarding HOLC on FHA, because Light push mostly neglected problems in the racism. FHA management leftover clearly racist and you may classist vocabulary regarding Underwriting Guidelines up to exhausted to eradicate it inside 1952. Charles Abrahams, a payday loan Ball Pond gloss-created reasonable houses pro when you look at the Nyc, penned in 1955 one to FHA followed an effective racial plan that could well was culled about Nuremberg statutes by form in itself up as the the newest guardian of all white area. thirty-six