Securing Homeowner’s Insurance policies

It is not only necessary for a loan application, however, homeowner’s insurance rates c an become lifestyle-preserving in times off catastrophes, accidents, otherwise thieves. Usually, insurance agencies will offer visibility getting accountability and medical can cost you in the event the anyone would be to hurt by themselves on your property otherwise ruin the newest home and you may property itself

Whenever seeking homeowner’s insurance coverage, you may want to seek https://cashadvanceamerica.net/installment-loans-az/ multiple company, because specific might have different will cost you and you may exposure selection. Understand that some homeowners’ insurance coverage might not coverage such things as flooding or any other disasters, and other insurance may only cover certain areas or improve the costs if you reside in certain aspects of Idaho. Such as for instance, if you reside near a river, you may need to buy so much more coverage but if it floods.

- Premium: Extent you pay for your insurance coverage, usually a year or month-to-month.

- Deductible: The quantity you only pay up front towards a claim in advance of the insurance kicks inside the.

- Exclusions: Specific situations otherwise factors maybe not covered by the policy.

- Riders/endorsements: Add-ons so you can a basic rules to add even more exposure to possess some thing including highest-value jewellery or disasters.

Interest rate Secure

The fresh Government Set-aside, or the U. For that reason control, rates is vary each day, requiring the use of interest rate tresses.

Mortgage secure is a binding agreement amongst the borrower and you can the financial institution one to pledges a particular rate of interest into home financing to own a predetermined several months, normally 29 to 60 days. This secure covers you against rate expands while they procedure the mortgage. Often, might strategically secure your own speed on a decreased several months you can save currency across the lifetime of your own home loan.

When going right on through this course of action, communicate with your lender on the when to place the lock. It’s adviseable to stay informed from the normal market conditions that you’ll alter federal interest levels.

Step seven: Closure Your house Pick

Brand new closure procedure are a phrase one surrounds each step shortly after you’ve gained approval out of your financial to suit your financing. Both you and our home vendor have a tendency to finish the escrow procedure throughout the this era. A keen escrow company tend to keep an element of the down payment to be sure the sale continues and you can play the role of an impartial group to collect the court and you can certified data files getting signing the latest marketing. Let us view what you are able expect throughout these weeks.

Finally Underwriting and you may Finalizing Closing Documents

Your own lender have a tendency to make a last underwriting to be sure the loan was real and provide the past records. They re-glance at debt reputation and look to find out if your credit, a position condition, or any other high transform possess altered. They might also recheck the house to be certain it suits the market price. Once they’ve offered the last underwriting, they’re going to together with offer the after the files about how to sign:

- The loan otherwise action from trust: That it protects this new mention and gives the lender a claim against the home if you’re unable to meet the financial terms and conditions.

- The promissory notice: It’s your commitment to repay the mortgage.

- The fresh closure disclosure: Which document provides last facts about the loan, including the interest rate, monthly installments, as well as the expenses associated with this new closure.

- Affidavit of your term: The latest file commercially transmits the home term to your title.

- Transfer income tax declaration: So it document transmits one taxation generated on the behalf of the home for the title.

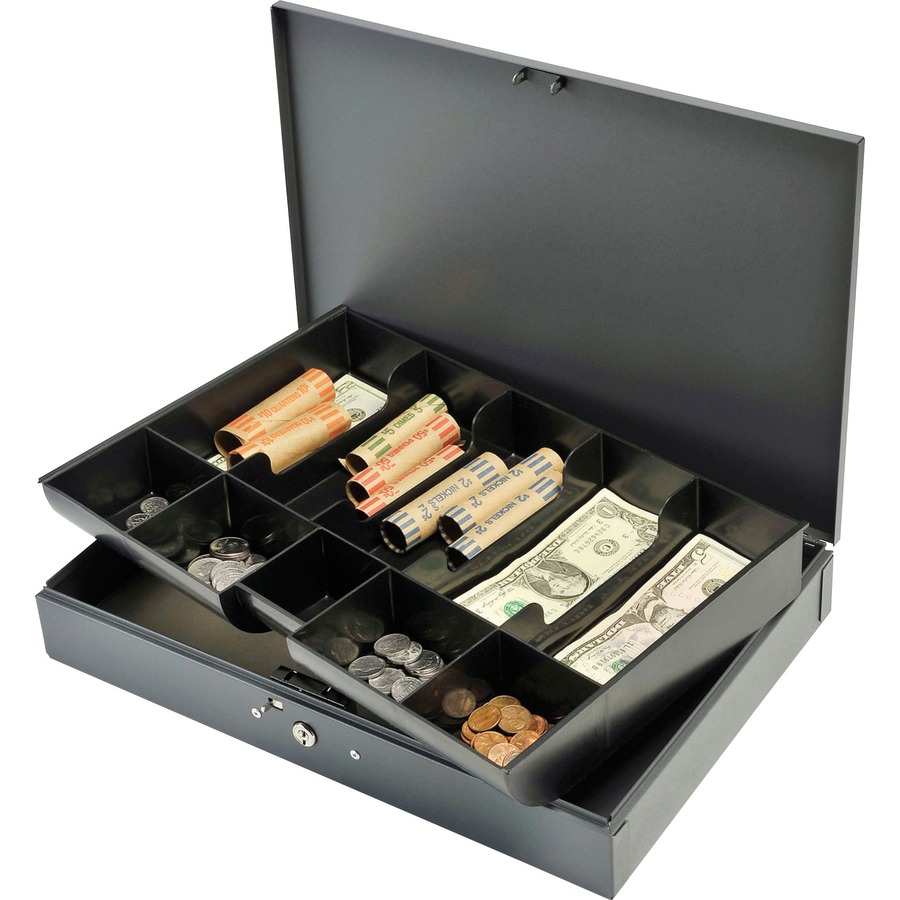

You ought to likewise have files for the bank and the vendors, including proof of homeowner’s insurance, a credit card applicatoin, an excellent cashier’s seek out settlement costs, and you will a government-issued ID.