Because of the definitely working to reduce your monthly personal debt repayments, you might free up a lot more of your revenue to satisfy home loan debt.

Techniques to Straight down Personal debt-to-Earnings Ratio

Cutting your obligations-to-money proportion relates to controlling and you can cutting your monthly personal debt money relative toward income. Consider the after the steps:

- Boost money: Speak about possibilities to boost your earnings, particularly trying out a side occupations otherwise freelance really works. Boosting your income will help stabilize the debt-to-money ratio.

- Discuss a top salary: If at all possible, discuss the probability of a higher income together with your manager. Increased income can absolutely impact the debt-to-money proportion and you can alter your mortgage eligibility.

- Reduce present money: Manage paying down established finance to cut back their monthly debt obligations. Focus on financing which have higher interest rates or larger balances to own a more high effect on the debt-to-earnings proportion.

Always keep a record of one’s progress as you get rid of your debt and you can change your loans-to-earnings ratio. So it files can be useful when reapplying to own a mortgage otherwise approaching alternative lending organizations.

From the earnestly handling your debt and dealing to your a stronger personal debt-to-earnings proportion, you could enhance your mortgage qualification and increase your odds of securing the loan you need to unlock the homeownership desires.

Seeking to Some other Lending Organizations

You to choice to think wants various other financing organizations. Non-depository loan providers, specifically, s that you may be eligible for. These firms work away from conventional banking institutions and borrowing unions, delivering alternative avenues to own getting a mortgage loan.

Non-Depository Loan providers

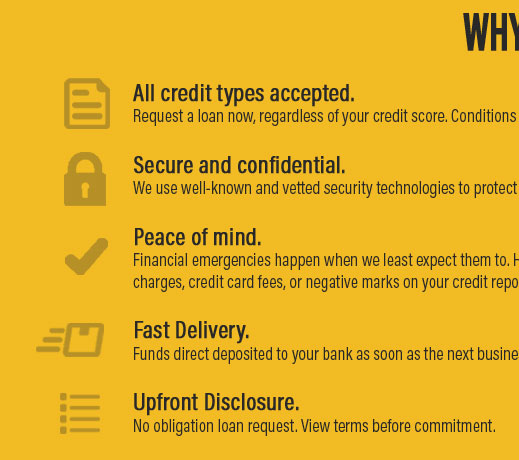

Non-depository loan providers was creditors which aren’t on the antique depository banking institutions. They could are mortgage enterprises, online lenders, or credit unions one to desire mostly to your financial lending. These lenders will often have some https://availableloan.net/payday-loans-va/ other underwriting requirements and may even be more versatile with respect to giving home loan apps which were refused of the antique financial institutions.

Coping with non-depository loan providers can present you with other available choices and possibilities to safe an interest rate. They s created specifically for people who was in fact declined of the almost every other lenders. By exploring these choice financing institutions, you enhance your odds of seeking home financing provider that fits the money you owe.

Great things about Dealing with Solution Lenders

- Versatile Conditions: Non-depository loan providers may have much more lenient eligibility criteria as compared to traditional banks. They might think facts beyond merely fico scores, for example a job history, earnings balances, plus the total monetary picture of the latest debtor.

- Specialized Apps: Option loan providers will render authoritative mortgage software designed to particular items. For example, it s for people with lower credit ratings, self-employed people, or those people trying fund to have unique possessions designs .

- Brief Approval Process: Non-depository loan providers covered recognition procedure as compared to antique banking companies. This is of good use if you are looking so you can safe a mortgage rapidly.

- Accessibility More Loan Circumstances: Choice loan providers may offer a greater list of loan situations, for example authorities-backed fund, adjustable-rate mortgage loans, otherwise formal applications getting earliest-go out homeowners. Based on your unique need and you will situations, these loan choice get ideal line up along with your monetary specifications.

Whenever trying more credit establishments, it is essential to do your homework and you will examine the conditions, interest levels, and you will charge offered by various other lenders. Make sure to understand their underwriting procedure and eligibility criteria to ensure that you prefer a loan provider one best suits your own needs.

Think of, regardless of if your application might have been refused because of the you to financial, this does not mean you may not be able to safer a home loan. Investigating choice loan providers normally start brand new selection while increasing the likelihood of obtaining the mortgage you really need to fulfill the homeownership goals.