This includes both the money that has been deposited and the money that has been withdrawn. The cash flows will change with every transaction that is recorded in the petty cash book. The cash book is a chronological record of the receipts and payments transactions for a business. Therefore, the bank credits the account holder’s personal account, and the entry appears in the Cr. As a matter of practice, banks send a list of entries to each account holder that have been made in their personal account, which is maintained by the bank. Most businesses ask for their bank statement at the end of each month.

FAQs on Cash Books

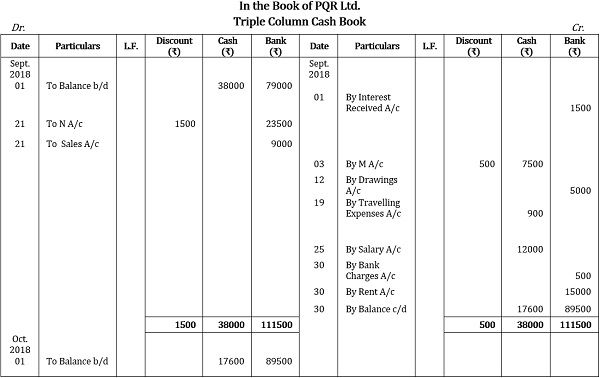

Mistakes can be detected easily through verification, and entries are kept up to date, as the balance is verified daily. By contrast, balances in cash accounts are commonly reconciled at the end of the month after the issuance of the monthly bank statement. P&G LLC records its cash and bank transactions in a triple-column cash book. The main difference how to prepare an income statement between a cash book and a journal is that a cash book tracks payments and receipts. A cash book is a separate ledger in which cash transactions are recorded, whereas a cash account is an account within a general ledger. A cash book serves the purpose of both the journal and ledger, whereas a cash account is structured like a ledger.

Step 2 – Writing the Transactions

There is one on each side for recording discounts, cash, and bank amounts. One column shows cash receipts and payments, the second records banking transactions, and the third notes discounts received and allowed. Keeping records of business transactions is crucial, so properly maintaining the books helps businesses run smoothly. The P&G LLC records its cash and bank transactions in a triple column cash book.

Where is the Cash Book entry posted?

Both cash receipts and cash payments are recorded in a cash book. The cash book is also regularly reconciled with the bank statements as an internal auditing measure. A cash book is an important tool for businesses to help track their finances.

- There are numerous reasons why a business might record transactions using a cash book instead of a cash account.

- Three-column cash books (or triple-column cash books ) have three money columns on the debit and credit sides.

- The following transactions were performed by the company during the month of June 2018.

- The other side of the cash book has the heading ‘Credit’ and shows an identical format with the single column representing the monetary amount of the cash payment.

- The same procedure is followed for posting entries from double as well as triple column cash books to ledger accounts.

Transactions are recorded in a single column and the total amount of money received or paid out is updated at the end of each day. This type of cash book is mostly used by individuals who are tracking their personal finances. The procedure of posting entries from a cash book to ledger accounts has been explained in a single-column cash book article.

Double-Column Cash Book

Cash discount is a reduction in the price charged for goods when a credit customer settles their debt within a time period given by the supplier. Cash discount acts as an incentive for credit customers to settle their debts quickly (prompt payment). Cash discount can be allowed to credit customers and received from credit suppliers. Cash books record all transactions for cash, checks, money orders, or postal orders.

Businesses use cash books to remain aware of their position with banks, while banks maintain records to ensure their position with an account holder is known. Single-column cash books (also called simple-column cash books) show cash entries received (receipts) on the left side or the debit side. In contrast, the right side or credit side contains cash payments.

At the end of an accounting period, both columns are balanced, and closing balances are properly transferred. A triple column cash book is the most complex type of cash book. This type of cash book is used by businesses who want to track each individual transaction in the most detail possible.

The cash ledger book can act as both a journal and a ledger and comes in various formats. In a three column cash book, three columns are provided for the amounts on each side. One column records cash receipts and payments, the second records banking transactions, and the third records discounts received and allowed. Most business owners today use accounting software to maintain books. However, knowing how to balance a cash book is still beneficial.