On July 2, BWWdetermined that Sea Ferries dishonored its note and recorded thefollowing entry to convert this debt into accounts receivable. Before realization of the maturity date, the note isaccumulating interest revenue for the lender.Interest is a monetary incentive to the lenderthat justifies loan risk. The interest rate is the partof a loan charged to the borrower, expressed as an annualpercentage of the outstanding loan amount.

Accounts Receivable Journal Entries

This extended payment timeframe is agreed upon between you and the customer (the debtor) by using a promissory note. A promissory note helps enforce your legal claim to the debtor’s payment. So far, our discussion of receivables has focused solely on accounts receivable. Companies, however, can expand their business models to include more than one type of receivable.

Accounting for Notes Receivable Accounting Student Guide

- If the debtor defaults, the note serves as evidence to compel payment.

- So the ending note balance here is the principal amount plus the interest calculated through the maturity date.

- This means, you deliver goods or render services, send the invoice, and get paid for them at a later date.

- It is classified as current assets or noncurrent assets depend on the term on a promissory note.

The principal of a note is the initial loan amount, not including interest, requested by the customer. If a customer approaches a lender, requesting $2,000, this amount is the principal. The date on which the security agreement is initially established is the issue inheritance tax date. A note’s maturity date is the date at which the principal and interest become due and payable. For example, when the previously mentioned customer requested the $2,000 loan on January 1, 2018, terms of repayment included a maturity date of 24 months.

Impact On Cash Flow

Notice that the sign for the $7,835 PV is preceded by the +/- symbol, meaning that the PV amount is to have the opposite symbol to the $10,000 FV amount, shown as a positive value. This is because the FV is the cash received at maturity or cash inflow (positive value), while the PV is the cash lent or a cash outflow (opposite or negative value). Many business calculators require the use of a +/- sign for one value and no sign (or a positive value) for the other to calculate imputed interest rates correctly. Consult your calculator manual for further instructions regarding zero-interest note calculations.

In case company A dishonours the respective Notes Receivable, B converts it into Accounts Receivable. Let us assume company A is the customer of company B that makes a purchase worth $500,000 and need an extended amount of time for repayment. Upon the request from company A, B makes assents to accept notes receivable with an interest of 10% and a term of 24 months. The principal part of a note receivable that is expected to be collected within one year of the balance sheet date is reported in the current asset section of the lenders balance sheet.

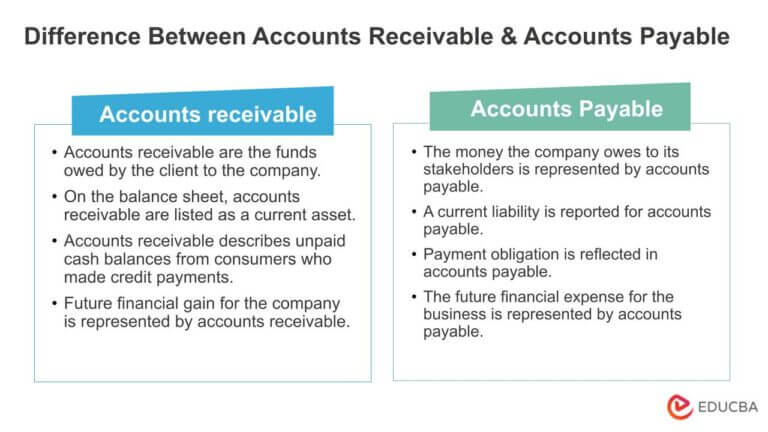

Meanwhile, accounts receivable (AR) consists of incoming payments owed by customers. Examples include invoices issued to customers for products or services rendered. If it is still unable to collect, the company may consider selling the receivable to a collection agency.

Thus, Interest Revenue is increasing (credit) by $200, the remaining revenue earned but not yet recognized. Interest Receivable decreasing (credit) reflects the 2018 interest owed from the customer that is paid to the company at the end of 2019. The second possibility is one entry recognizing principal and interest collection. For example, if a business wants to borrow $7,000, Square might charge a total of $7,910 for the loan. Upon approval, the $7,000 is deposited into the business’s checking account the next day and then Square charges 9% of the business’s credit card sales each day until the $7,910 is fully paid. Square says that the advantage of this percentage-of-sales method is that the business does not have to make large payments when business is slow.

The note may specify that the interest is due at the maturity of the note. Or, it may specify that interest will be due at certain points during the note’s duration (monthly, quarterly, semi-annually). A Note Receivable is recorded when a company is on the “receiving” side of a debt.

Uncollected accounts receivable will become bad debt expenses which impact the income statement. Notes receivable is the promissory note which the company owns and expect to collect in the future base on term and condition. The promissory note gives the legal right to the holder to receive a specific amount in the future. The borrower has the obligation to pay otherwise they need to face with law. A customer will issue a note receivable if for example, it wants to extend its payment terms on an overdue account with the business. Prompt AP payments improve a business’s credit with suppliers, while well-managed AR indicates reliable cash flow, supporting creditworthiness with lenders.

The interest rate is the part of a loan charged to the borrower, expressed as an annual percentage of the outstanding loan amount. Interest is accrued daily, and this accumulation must be recorded periodically (each month for example). The Revenue Recognition Principle requires that the interest revenue accrued is recorded in the period when earned.

Accounts payable (AP) signifies cash outflows since a company needs to make payments to suppliers, directly reducing available cash. If the note comes due within a year or less, then the Note Receivable is part of your current assets and will be noted as such on your balance sheet. If the note gives the debtor more than a year to pay, then the receivable becomes a long-term asset. There are a few big advantages to managing your accounts receivable effectively. For one, it can help you optimize your cash flow and increase your working capital.