What exactly is a low-recourse mortgage? Who’re lenders? Precisely what does they try be considered? Mentioned are a few of the concerns we have asked. Out of your mortgage professionals, we will supply the run-down out of all you have to see regarding the low-recourse mortgage resource.

What is actually Low-Recourse Financing Funding?

A non-recourse mortgage is actually financing secured from the guarantee, which is constantly some kind of possessions. In the event your borrower non-payments, brand new issuer can seize this new collateral but you should never seek out the debtor for your next compensation, even when the collateral cannot protection a full value of the defaulted amount. Basically, lenders can collect new guarantee but can not pursue the brand new borrower’s almost every other property.

If you find yourself potential individuals could find it attractive to get a good non-recourse loan, these types of funds have a tendency to include large interest rates. They usually are set aside for people and you will people which have excellent borrowing from the bank histories.

Just how Is Low-Recourse Fund Unlike Recourse Money?

Non-recourse finance establish a limit around and this the lender can also be seize their assets if there is a default; that’s up to the worth of the collateral. In addition, recourse funds allow the bank to seize assets besides the equity whether your financial obligation exceeds the value of the latest collateral. You can get guarantee for both type of financing. Everything you need to carry out is actually indicate the home/ attributes is seized should you default.

Non-recourse loans enjoys large interest levels than recourse fund and you can require you to provides impeccable borrowing (large credit ratings) so that you can take advantage of all of them.

Types of recourse and you may low-recourse funds:

Automobile finance are usually recourse funds; if you can’t retain the owed count, the lending company is also repossess your car or truck market they because of its market price.

Non-recourse loans might be availed of the enterprises or people with a a good credit score record. Extremely antique loan providers choose offering recourse money to prevent the possibility of reduction in the big event off non-payments. Yet ,, when you yourself have excellent fico scores, lenders can be even more willing to share a non-recourse financing, even if within highest interest levels.

In which Was Low-Recourse Fund Utilized?

Such finance are often used to money industrial real estate strategies or other tactics that are included with a long conclusion period. In the example of a property, the fresh new belongings will act as collateral into the loan. A low-recourse loan is even found in financial industries, with securities place because the collateral.

How can i Qualify for Low-Recourse Funds?

Demonstrably, all the risk and you can coverage which have non-recourse loans sleeps with the bank. Ergo, a low-recourse loan may be harder to help you be eligible for than just an excellent recourse loanmercial loan providers will often just increase low-recourse loans to finance certain types of attributes and simply to worthwhile borrowers. Stable finances and you will good credit history are a couple of of your own vital issues that a loan provider will at the. Generally, the mortgage requires the assets become a larger city, enter great condition, and have an effective historical financials, also. To help you qualify for a low-recourse loan investment, you’ll want:

- Large credit ratings

- The lowest mortgage-to-worth ratio

- A stable revenue stream

- No online personal loans ID less than a-1.twenty-five loans service visibility proportion (DSCR)

- Not be the majority of your house

- Become depending immediately following 1940

- Enter the usa

- Enjoys a threshold that isn’t shared with virtually any services

Which are the Benefits associated with Low-Recourse Money

- A assets aren’t associated with the loan, meaning even although you default to your money, the lending company can only just grab this new security but never follow a possessions.

Did you know non-recourse fund benefit home think?

Extremely commercial real estate consumers do not think too-much on the what would eventually the loan whenever they pass away. Tend to, they think that whenever the heirs inherit the property, they inherit the borrowed funds as well. Having a good recourse financing, the brand new heirs would have to qualify with the exact same certification just like the amazing proprietor. When your heirs do not be considered, the borrowed funds is entitled, ultimately causing a demanding condition on the 11 th hours.

With a non-recourse mortgage, the mortgage is made to just one resource organization including a keen LLC in lieu of a single otherwise private. In most cases, this new heirs’ monetary qualifications aren’t expected provided the fresh new financing money are still made timely.

Simple tips to Know if The loan is actually Recourse Otherwise Non-Recourse?

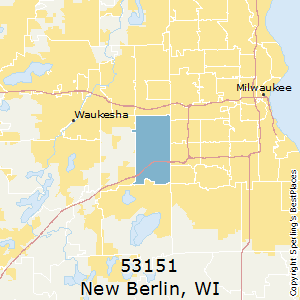

The home loan kind of relies on your state, and there’s a dozen states that allow each other recourse and you can low-recourse money, namely- Alaska, Arizona, California, Connecticut, Idaho, Minnesota, North carolina, Northern Dakota, Oregon, Colorado, Utah and Arizona. Usually, it would create no change if or not you’ve got a good recourse or non-recourse loan if you do not fail to pay off new borrowed number.

For other types of financing, eg charge card costs or automobile financing, go through the conditions stated in the initial data files or ask their lender if you’re unclear. Focus on your financial to avoid defaults, especially when you have an excellent recourse financing.

I’ve Your back on Fidelity Lenders

During the Fidelity Lenders, we are able to help you hold the best mortgage for your needs. To begin, get in touch with Fidelity actually within or contact us from the .