Yet not, for many who stand alert to the requirements, you could potentially stand prepared ahead and then make the needed behavior promptly.

Readily available collateral

The level of security need are very different from the lender. Here, the most LTV will generally come between 65 and you may 85%, according to the designed utilization of the money therefore the style of regarding property you want to pick. It indicates you need to take care of in the 15 so you’re able to thirty-five% out of security.

DTI ratio

The lenders use your own DTI proportion to check on your ability in order to borrow. Each one of the loan providers will receive the restrictions, you could anticipate the quintessential so you’re able to cap the DTI ratio at forty% otherwise reduced.

Credit https://paydayloansconnecticut.com/cornwall/ rating

The lenders also provide pre-calculated credit history criteria to possess providing the capital. If you have a card less than 620, needed make it possible to get the expected resource.

Fees conditions

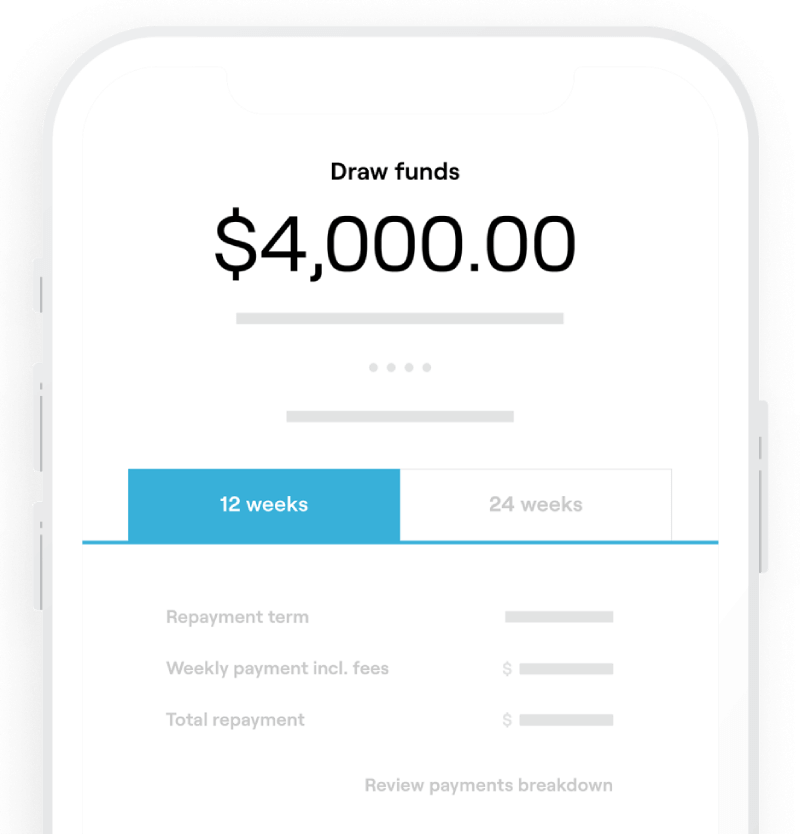

Keep in mind that belongings equity financing enjoys shorter loan terms. Yet not, they are going to are different significantly from a single financial to some other.

Usually, the loan title is ranging from ten and you will twelve many years. So, continue looking for ways to look for an exclusive money lender to include your on best deal you’ll.

Loan numbers

And additionally, it’s important to remember that some lenders keeps a max amount borrowed from $50,000. The remainder ount as long as you are below the restrict LTV ratio or even in a similar assortment.

However, you ought to check out the lenders and remember that the lender usually generally offer less for empty homes, such as for instance home which have nothing on it, than simply house which was notably arranged otherwise has many system.

Can it be realistic to utilize home as the security for a financial loan?

Once you see they into the a complete basis, then a land security mortgage is the best choice for those who

- Features excessively equity inside their property

- Is convinced they are able to manage to afford the repayments on time

- Have no intends to build on the home soon

Unless you plan to create on residential property

They utilizes your residence to improve your financial status, instance paying down large-appeal financial obligation. Yet not, it does simply be suitable if you are sure you could potentially keep up with the a lot more mortgage payment.

If you do not provides a stronger stone plan for spending off the the fresh new loan and therefore are substitution brand new small-identity debt with another type of enough time-identity loans, you might search into a deeper economic gap. Using equity to pay off higher attract you are going to stretch brand new agony and you may place you and your land on the line.

If you plan to build towards home

When you yourself have close-label agreements to have building on the property, taking out fully a secure equity loan will be top. Here you will find the reason.

You can limit your capability to get a homes loan afterwards if you funds the latest down payment to possess a houses loan having fun with equity. Given that construction is more than, your home was eligible for a traditional financial.

Although not, that isn’t you’ll for many who tie up the collateral throughout the case of an area collateral loan. In such instances, you might have to built a finances downpayment towards structure if necessary. A land equity mortgage may also number up against your own DTI ratio, that is extremely important when you look at the qualifying for a casing mortgage.

You are going to unnecessarily place your residential property and you can home at stake if the you plan to put a produced family on the floor or make use of your house equity to have an advance payment. In such instances, you should as well as think hard in regards to the additional options.