Once you remember do it yourself, it is likely that Home Depot is the earliest brand in order to pop music towards your head-and not just for the attention-getting label. The major merchant has actually spent ericans repaint the walls, enhance their faucets, cut the lawns, and even decorate their houses into the holidays (we can’t disregard the several-feet skeleton which makes surf all of the Halloween night).

Popular Lookups

While checking out your regional Domestic Depot for the a quite regular basis, you have observed the home Depot Credit rating Cards. Simple fact is that store’s individual mastercard, although it has got their benefits, it is really not built for men.

1. It’s best designed for home renovators and you can creatives

Noticably, our home Depot bank card objectives a certain crowd-individuals who propose to perform a beneficial ount out-of home remodeling otherwise painting, and you may want to store in the home Depot.

If you find yourself an individual who really does a number of DIYing, or perhaps you may have a corporate where you render handyman performs, or you keeps a home investments…upcoming acquiring the Family Depot charge card would make experience, says Andrea Woroch, a buyers finance and cost management specialist specializing in credit card software. But it would not be something I would mountain to the majority informal customers.

2. It is good if one makes plenty of production

Possibly you’re trying out a whole new aesthetic for your home now and consistently waffle to your suggestions. One of several Family Depot mastercard advantages is you provides an entire 12 months and make a profit to the a buy.

Allow Muse matches you which have a company people that fits your aims and you will philosophy. Very first, come across your work path:

Sometimes you buy continuously, Woroch claims. I think people that has undergone a property renovation understands that…and therefore it is nice being make you to come back as opposed to racing otherwise needing to be satisfied with store credit. Of course, Family Depot’s go back coverage actually completely informal-specific vegetation are just returnable within this ninety days, while some will be came back in the year getting shop credit by yourself.

step three. It’s best for repeated large commands

Towards the Home Depot bank card, you receive 6 months off special financial support to the instructions from $299 or higher till the %% annual percentage rate (APR) kicks in.

Unique financing form it’s not necessary to shell out focus into a good large get if you pay the amount entirely once the fresh promotional months was upwards. That is useful when you’re needing a different washer/drier, or have a tendency to purchase a great amount of brand new appliances or high priced equipment to possess work projects.

The thing i like concerning the special funding is that it’s not just will be one to first year you subscribe, Woroch claims, noting that organization often has the benefit of most other offers. Particularly, already anywhere between immediately and , cardholders can be discover 12 months regarding funding for the storewide orders during the or a lot more than $299.

The business is additionally offering new cardholders doing $100 out of a being qualified get now until July 29. That said, Woroch adds, I really don’t think that anyone need to look at that and say, Oh, I automatically rating one hundred cash on my get. You will want to investigate small print-like the simple fact that you simply have the full $100 regarding your purchase in case your expenses try $1,000 or higher.

(Domestic Depot’s almost every other cards, Investment Loan and Pro Xtra Bank card, could be a beneficial alternatives for especially large hunting outings, otherwise times when need financing.)

cuatro. It does not rack upwards facts otherwise money back

The home Depot Mastercard cannot render lots of benefits like you pick with other general-explore reward notes, Woroch says. Such as for example, you don’t get hardly any money back or points towards orders generated with the credit to utilize since deals to help you future hunting travel.

You might also end up getting a minimal borrowing limit due to the fact due to companies mitigating risk, that could negatively apply to your credit score. What is nice on the having a premier credit limit is the fact that count that you have charged when could be an excellent down percentage of that available borrowing, Woroch says. That’s important since together with your credit history, one of the products is the loans-to-borrowing from the bank ratio.

Basically, although a normal Domestic Depot buyers, you’re not rewarded for the respect past simple efficiency and you can 0% interest into first 6 months.

You to definitely sweet most offer, not, is actually no responsibility to have not authorized charges-definition if someone steals your house Depot bank card, you might not feel held responsible for your instructions they make significantly less than the label.

5. Your credit report issues before applying

Woroch doesn’t strongly recommend trying to get the home Depot mastercard just like the your first charge card, especially whilst is only able to be studied yourself Depot locations otherwise HomeDepot.

Along with, almost every other cards could have finest cashback also offers otherwise functions for the same purchases. There absolutely are notes which could have a spinning category in which you get dos so you can 5% cashback one to quarter towards the a house upgrade store, or possibly they might be providing a bonus cashback throughout the a particular month of the season, she claims.

Note, too, that canceling it after you’ve got your own complete out-of domestic looking was a danger too. Canceling your cards will reduce how much readily available borrowing from the bank you inform you on your credit reports, ergo affecting your financial obligation-to-credit proportion.

When you is actually applying for a property or even to pick a car or rating a consumer loan or company mortgage, you’re should hold off to your closure that account while the you’re going to require that https://paydayloanalabama.com/semmes/ readily available credit revealed on your credit history, Woroch states.

House Depot Charge card: Is-it good for you?

When in question whether the Household Depot credit card ‘s the right disperse to you personally, Woroch implies performing a review of using activities. Really does do-it-yourself take up many place to your the mastercard statement? If that is over another kinds, then that would be advantageous to you, she says.

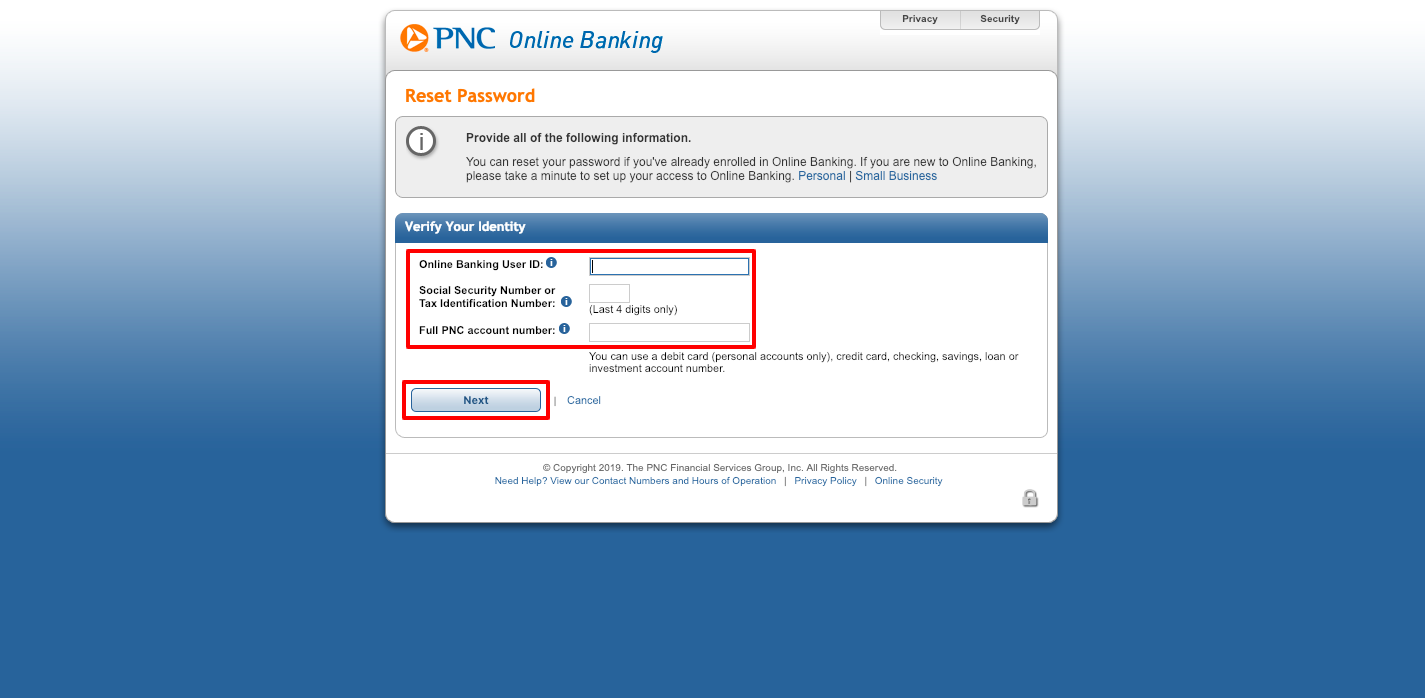

You can see for people who prequalify toward Domestic Depot borrowing card through Citi Merchandising Attributes without one affecting your credit rating.

In case Home Depot orders are only a tiny bit of the huge budgeting cake, Woroch contributes, it is really not extremely going to get your normally straight back as the getting a credit you to benefits your into category the place you manage spend most.