Whether you are a seasoned individual otherwise a primary-time visitors, navigating the house application for the loan process is going to be daunting. Follow this self-help guide to create the prime mortgage app.

Home ownership are an aspiration for the majority of Australians, and you may a home loan is usually the the answer to and then make that fantasy a reality. But with so many loan providers and solutions, the home application for the loan techniques can seem daunting. This guide will walk you through the measures of fabricating an effective home loan software that’s good and you will leaves your on the ideal standing to locate recognized on the mortgage you want.

Basic Home loan Eligibility

If you aren’t an enthusiastic Australian resident or permanent citizen, you truly must be inside the a great de facto relationships or partnered in order to an enthusiastic Australian resident or permanent citizen.

Essential Financial App Records

More lenders iliarise oneself with the so you can tailor the job accordingly. This might include indicating regular employment, good credit, or a robust coupons records.

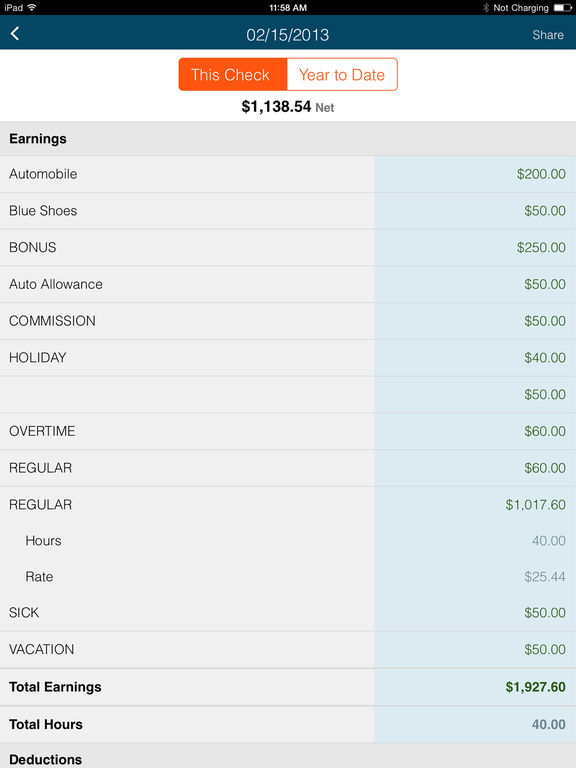

step 1. Rating Your entire Data Sorted

The first step of your property loan application try meeting every the necessary papers. This consists of evidence of label, money, assets, and you may debts. Having your documents sorted ahead of time have a tendency to speed up the method and relieve the likelihood of delays. Trick data were recent payslips, taxation statements, lender comments, and you may a recent ID. Organising these records will also make you a better picture of the money you owe.

2. Pre-Qualify for The loan

Pre-degree try a first step in which the bank brings a quote off exactly how much you can borrow. This can be according to the recommendations your bring about payday loans Frisco City your money, debts, and possessions. You will need to keep in mind that pre-qualification is not a guarantee out of loan approval, but it does give you a sense of your borrowing capability helping your address attributes affordable.

step three. Score Preliminary Recognition

Immediately after pre-being qualified, the next step is to get preliminary approval (labeled as pre-approval). During this stage, the lender performs a far more comprehensive overview of the money you owe. Preliminary approval suggests that the lender may likely give the currency, provided particular conditions are came across.

cuatro. Discovered Conditional Approval

As soon as your bank provides assessed your application, they may issue conditional approval. It means the loan is eligible in principle, but it is susceptible to certain requirements are came across. This type of requirements have a tendency to connect with the home you need to purchase and could tend to be an acceptable valuation.

5. Financial Can do a protection Research

The protection assessment is a life threatening part of the procedure. Right here, the lending company assesses the house you wish to buy to be certain its a suitable defense with the financing. This always involves a house valuation to decide if for example the property’s worthy of aligns along with your loan amount.

six. Score Lenders Home loan Insurance policies (LMI)

In case the deposit are below 20% of one’s property’s worthy of, you are necessary to score Lenders Mortgage Insurance rates (LMI). LMI covers the lender if you default to your financing. It is essential to cause of the price of LMI, that you can add a significant amount to your loan.

seven. Discover Finally Recognition

Latest recognition was offered when the requirements of one’s conditional acceptance have been satisfied, while the bank was satisfied with the security testing and you may any most other requirements. Thus far, the lending company usually confirm that he is ready to finance your own assets pick.

8. Financing Offer is actually Approved

Just after finally acceptance, their financial will matter a proper loan provide. That it document lines this new small print of your own loan, and additionally rates, cost agenda, or other information. Its imperative to comment so it promote very carefully and make certain you are aware all aspects of your own loan.