Virtual assistant and you can old-fashioned financing both allow for a loan restriction out of $453,one hundred – but not, an elementary fundamental FHA Forward financing allows $294,515

- Consult with certain lenders. Needless to say, private loan providers tend to set their unique conditions more strict as compared to minimum FHA requirements. If you find yourself having problems being qualified which have a particular financial, trying to moving forward to some other. They never affects to search as much as if you are in search of an excellent mortgage.

- Income limits. Because there is maybe not specified minimum earnings necessary to qualify for a keen FHA mortgage, you do have so that you can demonstrate that you try in a position to pay back the mortgage. If you’re there are not any income restrictions for those finance, he or she is aimed toward all the way down-money candidates. not, when you yourself have a high earnings, you may not getting disqualified, because you s.

- Financial obligation so you’re able to money rates. So you can qualify for an FHA mortgage, you also need getting a good debt to help you money proportion. Simply put, the total amount spent for the monthly loan costs will likely be relatively lower, in comparison to your income.

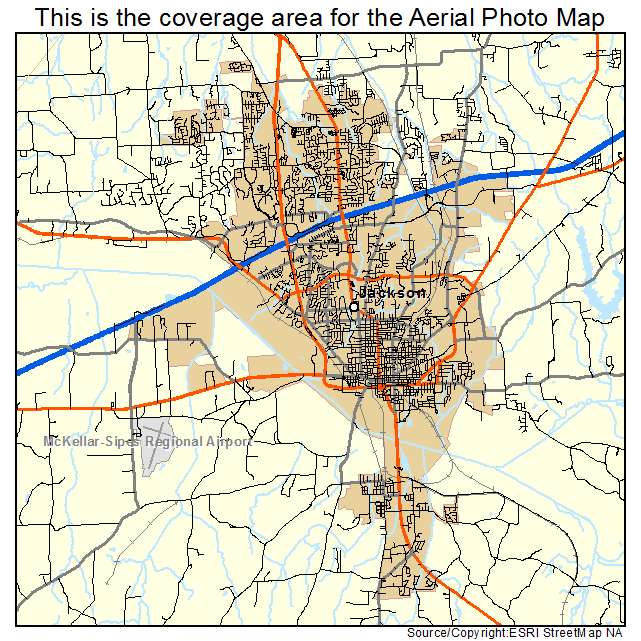

- Loan amount. The brand new FHA as well as constraints how much you can utilize use. Generally, you will end up simply for a modest amount borrowed, in line with the home cost near you. You can check out HUD’s web site to see your regional limitation.

Source: Brand new survey integrated 650 Residents which have approved mortgages. The research expected what their credit rating is and you may which one out-of loan they acquired. The new poll was drawn in .

Perhaps you have realized, FHA financing are a great option for people with straight down borrowing from the bank scorespared which have a traditional mortgage, in which individuals provides the common credit history regarding more than 750, an average user with an FHA financing possess a credit score regarding 686 – making this an even more achievable choice for alot more users.

Do you know the FHA mortgage constraints?

As previously mentioned a lot more than, youre limited on the matter that one can qualify for having a keen FHA home loan. Let us look more directly within limitations of a few different brand of mortgages.

Mortgage constraints by preferred mortgage systems to possess 2018 Description: An assessment of exactly what the mortgage restrictions try having preferred home loan mortgage sizes to own FY 2018

Than the Virtual assistant Loans and you may traditional mortgages, you will see reasonable difference in the brand new FHA Give mortgage. It is other example of how FHA was directed at reduced-income residents. The higher the mortgage, the greater new monthly mortgage payment would-be, thereby as the FHA possess a top limit, it might not fit making use of their created industry.

If the credit history isn’t really for which you like it to be, you can find things to do adjust your get. There are many factors that subscribe your credit rating, for every single with regards to own weight. Let us look closer less than:

Virtual assistant and you will traditional fund each other support a loan limit away from $453,a hundred – yet not, an elementary simple FHA Forward mortgage allows $294,515

- Commission History (35%). Your own percentage history is the unmarried greatest factor that results in your credit score. This proves prospective loan providers how many times your americash loans Daleville commission was in fact on date – or if they have been late or overlooked.

- Borrowing from the bank Use (30%). While this may seem tricky, their borrowing use is just the portion of your own total available borrowing that you are currently using. It count try shown just like the a percentage and you may, to store the best rating, you ought to keep count lower than 31%.

- Borrowing from the bank Many years (15%). The age or length of your credit history together with leads to their get. To make the the majority of it foundation, be sure to keep earliest accounts unlock plus in a great standing.